Crafting a solid omnichannel strategy for your retail business

There is an ever-increasing push from customers to continuously improve customer service efforts and to satisfy their wants and needs as best and as quickly as possible.

This is especially important for businesses operating in the incredibly competitive retail industry.

Consumers nowadays want to shop when they want, how they want and where they want and they want you to make that possible.

The good news is that you can satisfy these consumer needs with a simple solution – an omnichannel strategy.

What is an omnichannel strategy?

An omnichannel strategy interconnects a brand across multiple channels in order to ensure a seamless customer journey.

More and more customers are opting to shop on the go and value hassle-free, convenient shopping experiences.

Introducing an omnichannel strategy within your company will not only offer the service customers are asking for but will also drive sales and ensure positive customer experiences.

Why you should adopt this approach?

The Harvard Business Review (2017) conducted a study on the impact of omnichannel strategies on businesses.

The results from over 46,000 shoppers showed that 7% shopped exclusively online, 20% were store-only shoppers and 73% used multiple channels.

Moreover, the Harvard Business Review also found that customers offered an omnichannel experience were more likely to spend more online and in-store and continue returning to that company.

An omnichannel strategy is now considered a crucial part of any successful business.

The strategy offers an overall seamless experience with the protection and enhancement of the customer experience across all channels.

Without an omnichannel strategy, companies can expect to lose customers, customer share and eventually, any power within the market.

How to craft your omnichannel strategy

A solid omnichannel strategy begins with a single hub.

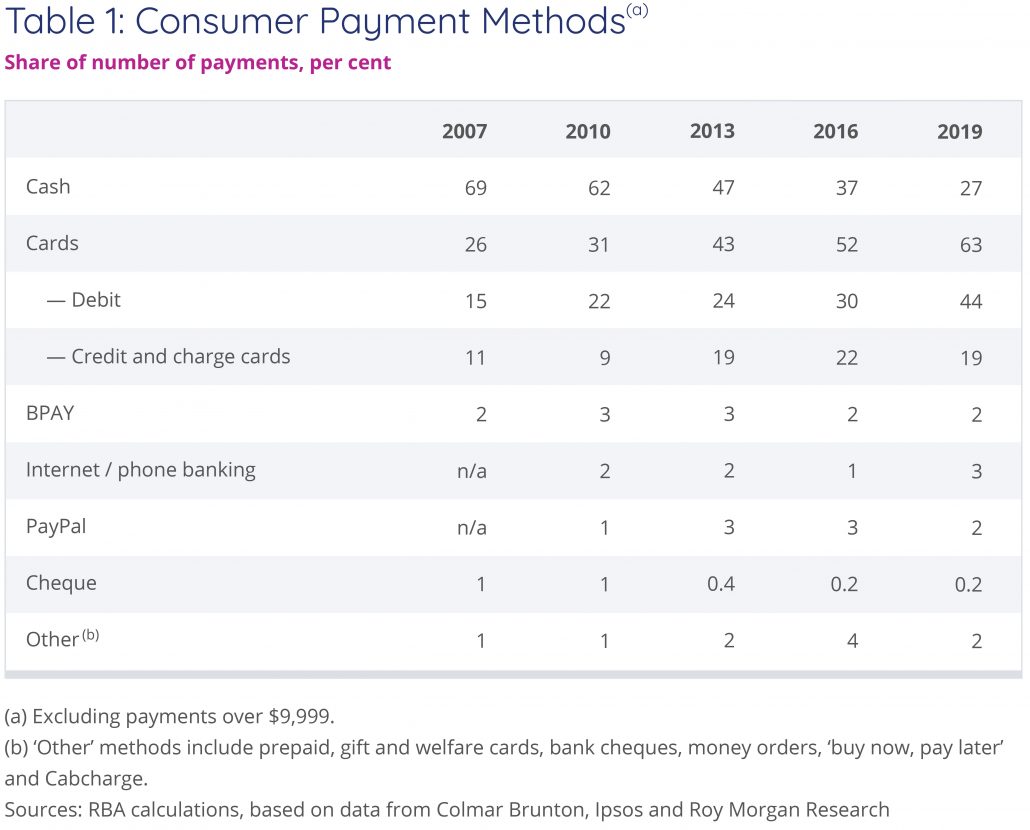

Through that single hub, you should have the ability to accept all customer payments across all possible sales channels.

Possible sales channels include via telephone, mobile payments, in-app purchases, online payments and point-of-sale device (POS).

Not only will a single hub offer your customers the convenience to shop wherever and whenever they want, but it also offers your company single integrated access to a truly global market reach.

Craft your solid omnichannel strategy for your retail business with LatPay

LatPay offers a hassle-free, simple integration that provides your retail business with a sophisticated, bespoke suite of services with a range of local and global payment methods.

The omnichannel payment hub works simply by offering customers the ability to purchase from your business wherever and whenever they choose.

This is made possible with LatPay’s industry-leading security processing and multi-currency gateway which has access to over 90 local and global payment methods.

This payment network then allows for real-time payments in line with PCI certification.

If you’re interested in utilising one simple integration across all sales touchpoints to provide your customers with the ability to shop however they please, LatPay is the solution.

Find out more about LatPay’s omnichannel capabilities and talk to the team today to discuss any queries you might have.